2019财政年度美国国家债务大增1.2万亿美元,总量相当于GDP的106.5%

本文来源于微信公众号“市川新田三丁目”,原作者Wolf Richter, 编译王为。

But what happens if there’s actually a recession?

如果美国经济真来个衰退会发生什么?

The US gross national debt jumped by $110 billion on the last two business days of Fiscal Year 2019, and by a breath-taking $1.2 trillion during the entire fiscal year, after having already jumped by $1.27 trillion in Fiscal 2018, the Treasury Department reported today. This ballooned the US gross national debt to a vertigo-inducing $22.72 trillion.

2019年10月1日美国财政部发布报告称,在美国2019财年即将结束的最后两天里,美国政府债务总量增加了1100亿美元,全财年政府债务新增了1.2万亿美元,而在2018财年里美国政府债务总量已经增加了1.27万亿美元,受此影响,美国政府债务总量已达到足以令人感到头晕目眩的22.72万亿美元。

美国政府债务总额每日更新数据发布在美国财政部的网页上www.treasurydirect.gov/govt/reports/pd/pd_debttothepenny.htm

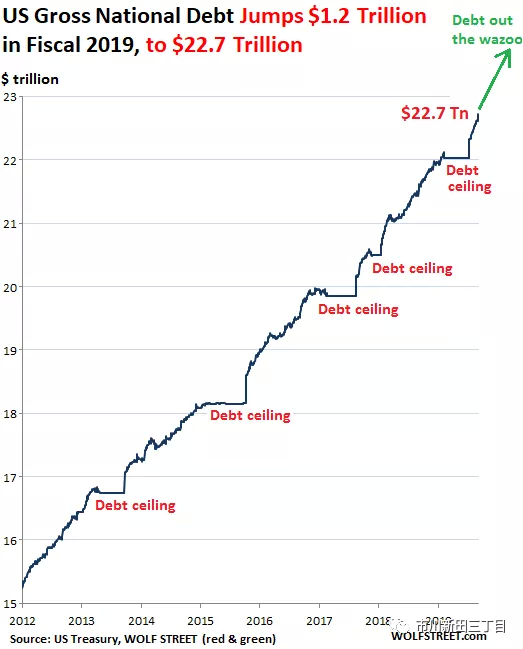

These beautiful trillions whipping by are a joy to behold: so much action in so little time. The flat spots in the chart below are the results of the debt-ceiling charade in Congress. When the debt ceiling is lifted, the debt spikes back to trend, and nothing changed:

看着这些金额数以万亿美元地增长是一件非常有意思的事情,在如此短的时间里金额增长如此之快。下图中平的部分是联邦政府与美国国会就是否提升债务上限而装腔作势争夺一番的结果,当债务上限被上调后,政府债务重回上升轨道,一切与往常一样:

During Fiscal 2019, the gross national debt increased by 5.6% and now amounts to 106.5% of current-dollar GDP, up from 105.4% at the end of Fiscal 2018.

在2019财年,美国政府债务增加了5.6%,如今总额相当于GDP的106.5%,高于2018财年105.4%的比率。

The thing to remember here is that this isn’t the Great Recession or the Financial Crisis, when over 10 million people lost their jobs and credit froze up and companies went bankrupt and tax revenues plunged while outlays soared to pay for unemployment insurance and the like. This isn’t even the Collapse of Everything, but the longest expansion of the economy in US history.

要注意这可不比1930年代的大萧条或2008年金融大危机那会儿,那时有上千万美国人失去工作,信贷渠道冻结,企业破产,预算收入大减但政府用于失业保险等用途的开支却猛增,现在可是美国历史上经济成长持续时间最长的时期。

Over the last four quarters, the US economy as measured by nominal GDP (not adjusted for inflation) grew by 4.0%. Over the same period, the US gross national debt grew by 5.6% (not adjusted for inflation).

过去四个季度,按名义GDP计算即未对通胀率进行调整的美国经济增速为4.0% ,在此期间,美国政府债务总额增长了5.6%(亦未对通胀率进行调整)。

In dollar terms, it looks even funnier: The economy as measured by nominal GDP over the past four quarters grew by $830 billion. The Gross National Debt grew by $1.2 trillion.

如果看绝对值,就更搞笑了:美国名义GDP在过去四个季度里增加了8300亿美元,而政府债务总额增加了1.2万亿美元。

How can this be?

为啥会这样?

For the first 11 months of Fiscal 2019 through August, the latest data available from the Treasury Department:

美国财政部提供了在截止到2019年8月份的2019财年前11个月的预算收支情况:

**Tax receipts increased by 3.4%, less than the growth of the economy (4.0%), thanks to the tax cuts.

税收收入增长了3.4%,低于GDP同期4.0%的增速,原因是受到减税的影响;

**Outlays soared by 7.0%, far outpacing economic growth (4.0%), as no one in Congress or in the White House even pays lip service anymore to the idea of budgetary discipline during good times.

财政开支增长7.0%,远超GDP的增速,在美国国会或白宫里甚至没人在当前这个经济尚好的时期提到应加强预算纪律这件事。

**With tax receipts growing more slowly than the economy, and outlays soaring 7.0%, it’s hard to have a recession, when you think about it. You’re buying the continued expansion, but you’re paying a very high price for that extra stretch, because some day, that expansion will end, and then what remains is the debt.

由于税收收入的增速低于整个经济的增速,而支出却大增7.0%,动脑筋一想就知道美国经济很难陷入衰退。美国现在的经济扩张等于是花钱买来的,但代价不低,因为总会一天经济扩张会走到尽头,剩下的全是债。

And that debt will then reallyblow out because, as they always do during a recession, receipts will plunge and outlays will spiral higher.

债务问题终有爆发的一天,因为正如在以往历次经济危机期间所发生的情况一样,财政收入会大幅减少而支出却会大幅增加。

But no problem, it’s just some trillions.

但这都不是事,只是几万亿美元的问题而已

The thing is, I get to write these articles once a year, every year, and have been for years, because it’s the same fiasco every year, all over again, only now it’s a little bigger.

事实上我每年都写一篇文章谈这个话题,每年都写,已经好几年了,因为问题每年都这么严峻,一而再再而三,只是如今欠的债又多了一些。

From Fiscal 2012, after the Great Recession was declared over and done with, through Fiscal 2016, the gross national debt increased on average by $947 billion per year. In Fiscal 2018 and Fiscal 2019, the gross national debt increased on average by $1.23 trillion per year.

从2012财年开始也就是肇端于2008年的金融危机被宣布已经完结后开始,一直到2016财年,美国政府债务平均每年增长9470亿美元,在2018和2019财年,美国政府债务平均每年增长1.23万亿美元。

Fed Chair Jerome Powell keeps saying that the US is on an “unsustainable fiscal path,” which is fine and dandy, but every time he says this, he sounds like a fossil that is completely out of touch with reality in Congress where all this got passed. “Sustain” for these folks in Congress means sustaining their campaign funds and sustaining them through the next election.

联储主席鲍威尔一直在讲“美国的财政收支状况是无法持续下去的”,话是没错,但他每次说这话的时候,就好比是个老古董远远脱离美国国会发生的实际情况,在那里美国政府的预算案每次都能获得通过。对于国会那帮人来说,“可持续性”指的是他们竞选资金的可持续性以保障他们能够一直混到下次国会议员选举。

扫码下载智通APP

扫码下载智通APP