昨夜,美联储说了哪些要点?

本文来自“智堡Wisburg”。

摘要

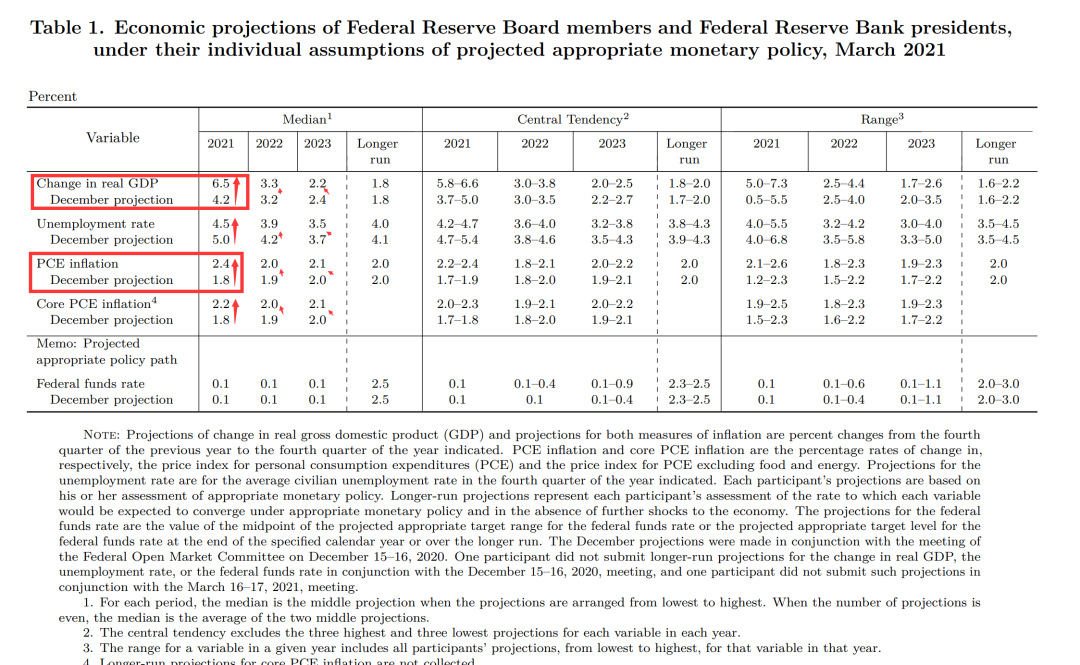

美联储大幅上调了对今年的经济预期,小幅上调了对未来两年的预期。(经济预测上调,失业率预测下调,通胀预测上调)

预计今年通胀将触达2.4%,但鲍威尔认为通胀的上行是短暂的。新框架下的联储希望看到通胀小幅超调,但仍希望保持稳定的长期通胀预期。

对银行业监管以及SLR指标问题不予置评,因为未来几天马上就会公布结果。

对于退出资产购买,鲍威尔给出了晦涩的触发条件,即“substantial further progress toward our goals”。

调整了隔夜逆回购工具的用量,但似乎市场并不当件事儿(本来就几乎没有用量)。

点评

综合鲍威尔在发布会上的表态来看,本次会议倾向整体偏鸽派,安抚了之前敏感的市场。

投资者需要关注三个要点,第一是联储重新拥抱了“数据依赖性”,并不断强调自己将按照新的平均通胀目标框架行事。整场发布会的交流内容的很大一部分都围绕经济预测展开,虽然不少记者仍然抓着点阵图几位官员的点不放,但鲍威尔很快将之解读为FOMC内部少数的不同意见,并强调了FOMC整体仍预期维持利率水平不变,以遏制市场加息预期前移。

图:有4位官员预计2022年就得开始加息

第二是联储虽然对今年的经济前景比较乐观,但是对于未来两年的经济走向仍然比较保守,从经济预测上也能看出这一点。FOMC成员并不确定今年的复苏力度是否可以延续。这和目前的市场预期是有较大分歧的(动不动就过热、大周期和高通胀),鲍威尔营造出的政策当局与市场参与者的预期差也带来了“鸽派”的效果。

第三是联储现阶段对市场认知的金融稳定风险嗤之以鼻,联储对金融稳定风险的考量是一个框架,而不是某个单一市场的表现。因此,各种基于单一市场表现“要糖吃”的预期都是市场自身的意淫(鲍叔对记者OT的问题的态度很不屑)。

发布会亮点

问题1:有关Taper,点阵图

鲍叔傻笑!Not yet!

We also understand that we will want to provide as much advance notice of any potential taper as possible. So when we see that we are on track, when we see actual data coming in that suggests that we are on track to perhaps achieve substantial further progress, then we'll say so. And we'll say so well in advance of any decision to actually taper.

如果做Taper会很提前跟大家做沟通,不要慌。

点阵图的前移只是一部分官员有改变

part of that is wanting to see actual data rather than just a forecast at this point

问题2:SLR,是否影响了货币政策实施。

未来几天马上会公布结果,拒绝回答

问题3:失业预测看什么指标?

看一系列指标。(建议重读Brainard的演讲)

强调经济预测(SEP)中并不包含所有联储官员参考的经济指标

问题4:经济预测的调整问题,对未来经济很乐观,为什么却不暗示加息呢?

SEP只是大家预测的集合而已,这份SEP忠于我们刚刚调整的框架。

The state of the economy in two or three years is highly uncertain, and I wouldn't want to focus too much on the exact timing of a potential rate increase that far into the future. So that's how I would think about the SEP.

未来两三年的经济前景不确定性很大,现在没必要太早考虑加息的确切时间节点。

问题5:多少的通胀会让你感到舒适?你的目标很晦涩,会不会让市场定价对通胀更低的容忍?

is talking about inflation is one thing. Actually having inflation run above 2% is the real thing.

谈论通胀是一回事,真实的通胀又是另一回事……

That's what we'd really like to do is to get inflation moderately above 2%. I don't want to be too specific about what that means because I think it's hard to do that. And we haven't done it yet.

鲍叔看上去好像对通胀没什么自信。

So over the years, we've talked about 2% inflation as a goal, but we haven't achieved it.

问题6:群体免疫会导致就业快速复苏,为什么联储的预测还是那么保守?

There will still be some social distancing.

让1000万人重返就业岗位不可能在一夜之间完成。

问题7:10年期国债收益率的问题,其他央行表态担心。OT的问题

I would be concerned by disorderly conditions in markets or by a persistent tightening of financial conditions that threaten the achievement of our goals.

The tools we have are the tools we have. 对OT的回答挺敷衍的,显然没当回事。

简单来说就是可以,但没必要。

问题8:就业市场族裔问题看什么指标?疫苗注射问题

没啥意思,看我们Brainard的那篇译文就好。

问题9:财政政策的问题,如何影响长期经济增长?

对短期:快速就业复苏和保障

长期:长期投资、生产率、劳工技术

看起来鲍叔和耶伦和拜登的基建政策看似一条心了……

问题10:欧元区经济似乎没跟上美国,你担心这种分化吗?会不会拖累美国经济增长?

复苏确实分化了,就像上次危机后那样。本土目标优先。

And we conduct policy, of course, here. Our focus is on -- our objectives are domestic ones.

We monitor developments abroad because we know that those can affect our outcomes.

记者问得不错,是做过功课的记者……

鲍叔回答的表态和2017年耶伦和费希尔的论调几乎一模一样,即联储考虑外部风险的前提是外部风险会冲击本土的政策目标。

问题11:银行业监管问题

日后再说

问题12:加息的问题,点阵图有人提前了加息预期,有争论吗?

加息的标准很明晰——双重使命

people on the Committee broadly say that uncertainty about the forecast is very high compared to the normal level.

强调不确定性。

So you are going to have different perspectives from Committee participants about how fast growth will be, how fast the labor market will heal, how fast inflation will move up, and those things are going to dictate where people write down an estimate of liftoff.

大家预测不一样。

It isn't meant to actually pin down a time when we might or might not lift off.

点阵图不是告诉你说那个时点就要加息了。

That will be very much dependent on economic outcomes, which are highly uncertain.

再强调不确定性和数据依赖性。

问题13:财政政策后续

联储决定不了财政支出,财政政策侧重于长期投资,这是货币政策做不到的,财政政策可以提高潜在产出。

问题14:金融稳定风险问题

是一个框架,不是一个市场的表现,记者显然没做过功课,根本不知道联储的金融稳定框架在其金融稳定报告里已经写得很清楚了。

问题15:SEP的问题,为什么到了合意的紧急状态还不加息?日本化?19年嫌利率太低现在怎么又那么鸽派了?

I would point out that over the long expansion, longest in U.S. history, ten years and eight months, rates were very low for -- they were at zero for seven years, and then never got above, you know, 2.4%, roughly.

美国刚经历一轮超长的扩张期,利率维持在0的水平有7年了,即便加了息也没超过2.4%

During that, we didn't see, actually, excess buildup of debt. We didn't see asset prices form into bubbles that would threaten the progress of the economy. We didn't see the things -- we didn't see a housing bubble. The things that have tended to really hurt an economy and have, in recent history, hurt the U.S. we didn't see them build up despite very low rates. Part of that just is that you are in a low-rate environment. You are a much lower rate environment.

这一段挺有趣的,言下之意低利率根本没有构成任何联储担心的金融稳定问题——比如资产泡沫和债务积压。(可能政府债务反正不用还?)

The connection between low rates and the kind of financial instability issues is just not as tight as people think it is. That's not to say we ignore it. We don't ignore it. We watch it very carefully. And we think there is a connection. I would say there is, but it's not quite so clear. We actually monitor financial conditions very, very broadly and carefully, and we didn't do that before the global financial crisis 12 years ago. Now we do. And we've also put a lot of time and effort into strengthening the large financial institutions that form the core of our financial system are much stronger, much more resilient.

话说得更死了,低利率和金融不稳定的关系没人们想的那么紧密。但很快鲍叔又太极了一波说我们现在也在时刻关注不稳定风险的。

问题16:就业和通胀的关系

There is a relationship between wage inflation and unemployment. But that has not -- what happens is that when wages move up because unemployment is low, companies have been absorbing that increase into their margins rather than raising prices. And that seems to be a feature of late-cycle behavior.

问题17:Taper的问题

What we are saying is substantial further progress toward our goals. We will tell people when we think -- until we say -- until we give a signal, you can assume we are not there yet. And as we approach it, well in advance, well in advance, we will give a signal that, yes, we are on a path to possibly achieve that, to consider tapering. So that's how we are planning to handle it. It's not different, really, from QE3, and I think we've learned what we've learned from the experience of these last dozen years is to communicate very carefully, very clearly, well in advance, and then follow through with your communications. In this case, it's an outcome-based set of guidance, as our rate guidance is, and it's going to depend on the progress of the economy. That's why it's not appropriate to start pointing at dates yet.

别怕Taper,会提前跟你们说!

问题18:居民部门储蓄释放会影响通胀吗?

大家出门消费了以后,供给又有瓶颈,就会出现价格小幅提升,但是供给会动态调整。所以是一次性的通胀拉升。

(智通财经编辑:庄礼佳)

扫码下载智通APP

扫码下载智通APP